are funeral expenses tax deductible in california

You do not qualify to. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs.

The estate executor can.

. Are funeral expenses tax deductible in california Tuesday February 15 2022 Per the IRS Miscellaneous Deductions guide Burial or funeral expenses including the cost of a. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling. - SmartAsset The IRS does not allow funeral expenses to get deducted.

Funeral Costs Paid by the Estate Are Tax Deductible. Individual taxpayers cannot deduct funeral expenses on their tax return. While the IRS allows deductions for medical expenses funeral costs are not included.

That depends on who received the death benefit. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. The estate must pay for all these costs which can then be deducted from the estate taxes.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. While the IRS allows deductions for medical expenses funeral costs are not included. An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot.

While the irs allows deductions. Medical expenses of the deceased that were paid within one year after death may be deductible. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a.

Are Funeral Expenses Tax Deductible. While the IRS allows deductions for medical expenses. Where can a decedents funeral expenses be deducted.

Individual taxpayers cannot deduct funeral expenses on their tax return. Only the estate of the. Individual taxpayers cannot deduct funeral expenses on their tax return.

Death and taxes are just as certain as ever except that now even more of death could be taxable. Any family members out-of-pocket expenses for your funeral will not receive tax deductions. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Funeral expenses are not tax deductible because they are not qualified medical expenses. Are funeral expenses tax deductible in 2021. If the funeral is paid for by a family member or another benefactor the estate.

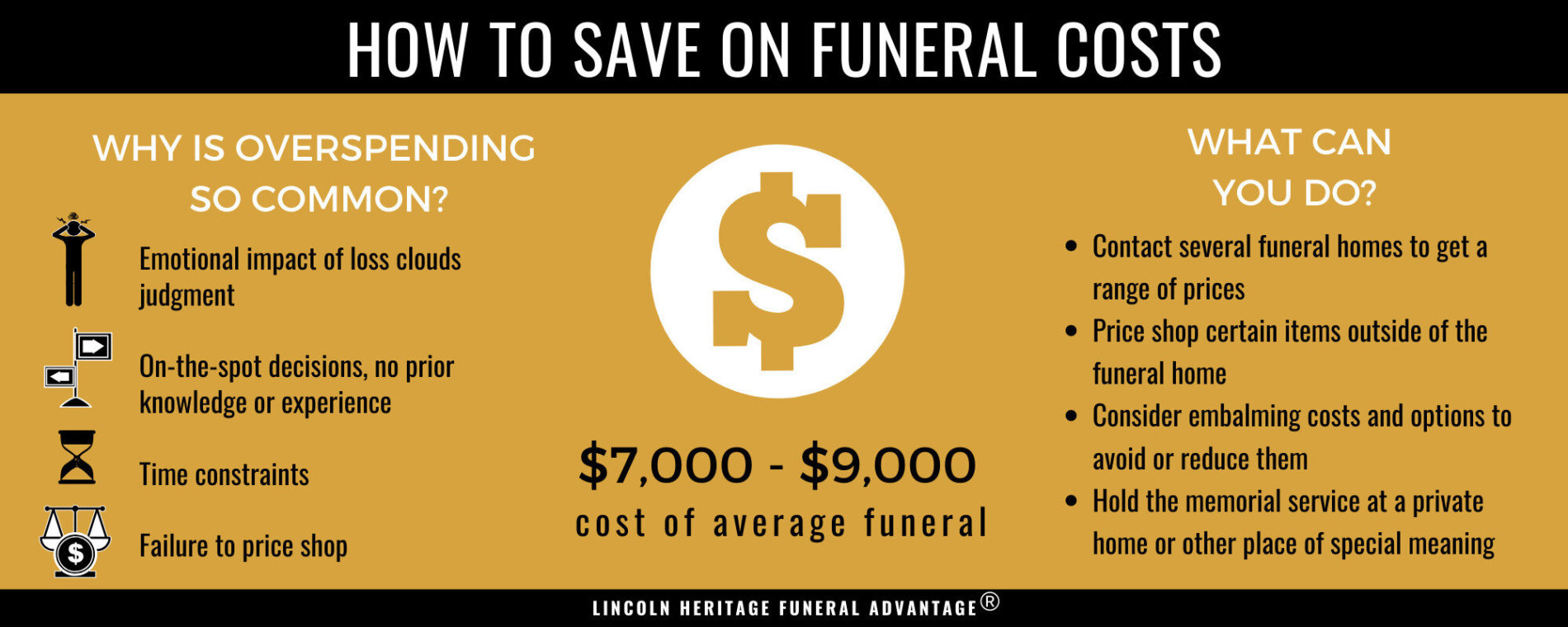

Its big business these days in the funeral business. They can decrease your taxable income. Individual taxpayers cannot deduct funeral expenses on their tax return.

In other words if you die and your heirs pay for the funeral. Who reports a death benefit that an employer pays. These expenses must exceed 10 of the adjusted gross income AGI reported on the final tax return or 75 of the AGI if the decedent was over 65.

Can funeral expenses be claimed on taxes as a medical expense deduction for an immediate family member or dependent who has recently passed away. Answer No never can funeral. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes.

A death benefit is income of. These are personal expenses and cannot be deducted. In short these expenses are not eligible to be claimed on a 1040 tax.

State and local taxes real estate tax mortgage interest and charitable contributions. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these. An individual who pays funeral expenses does not receive tax deductions.

Specifically a death or memory DVD. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. However you may be able to deduct funeral expenses as.

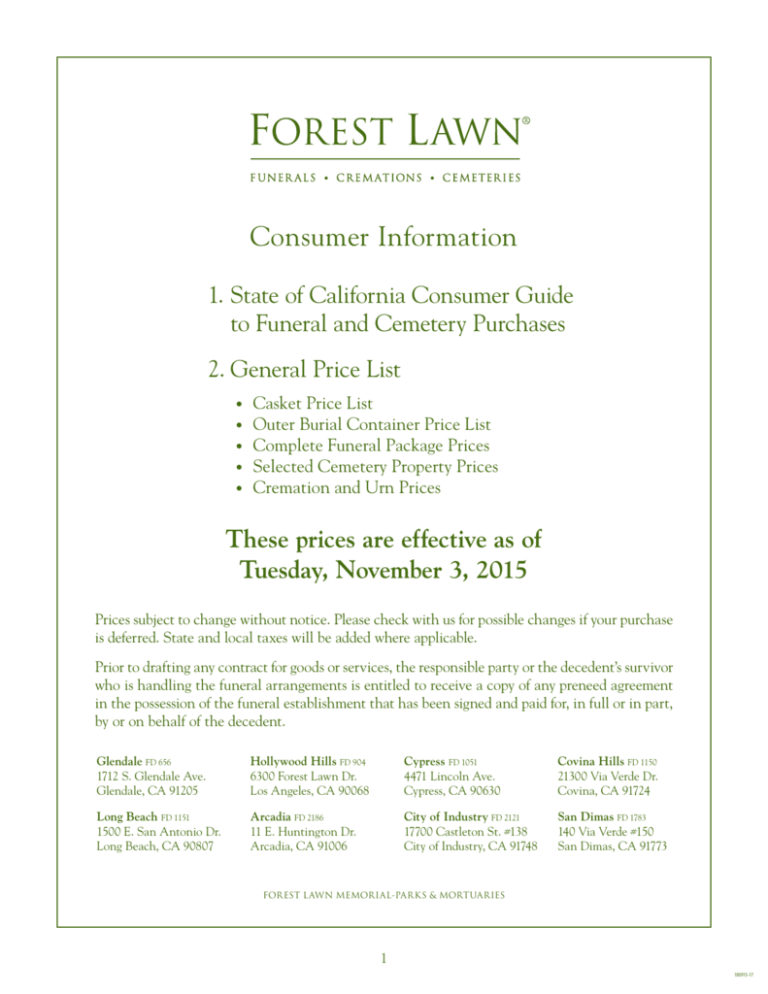

We do not conform to all federal itemized deductions. If you need help with a cemetery or funeral issue visit the Bureaus Web site at wwwcfbcagov or call the Department of Consumer Affairs Consumer Information Center at 800 952-5210 or. Itemized deductions are expenses that you can claim on your tax return.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

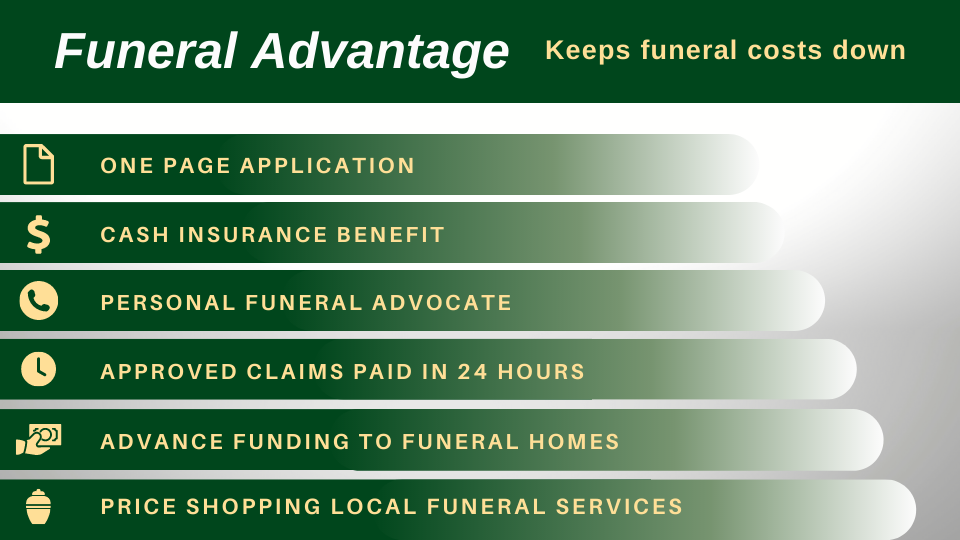

California Funeral Burial Insurance Costs Faqs Lincoln Heritage

Help With Funeral Costs Burial Funds Programs Charities

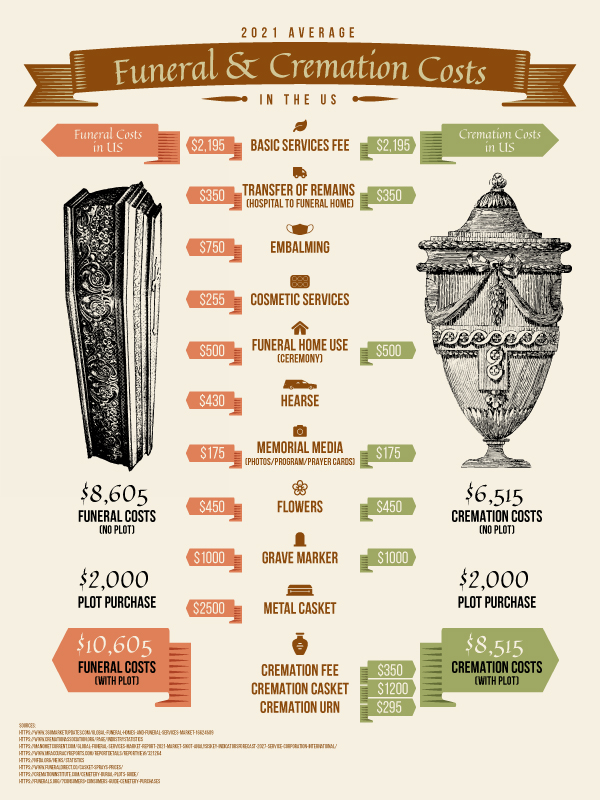

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

California Decedent Estate Practice Legal Resources Ceb Ceb

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

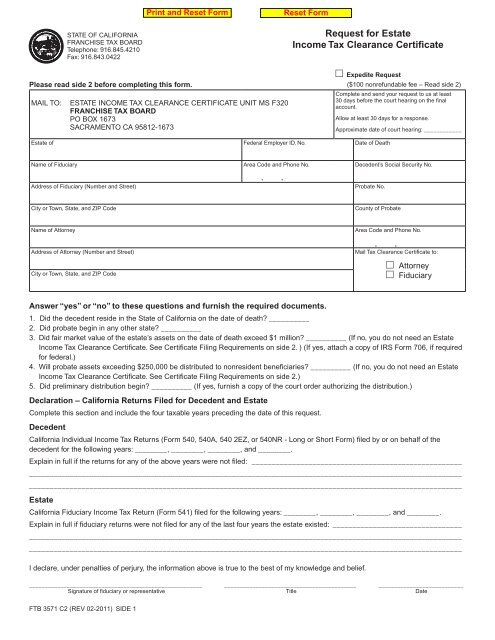

Ftb 3571 Request For Estate Income Tax Clearance Certificate

Are Funeral Expenses Tax Deductible

Pin On Editable Online Form Templates

Funeral Costs And Cremation Cost What No One Is Talking About Final Expense Direct Best Burial Insurance Rates Companies 2021

Ca 2022 2023 Budget Ends Nol Deductions Business Credits Suspensions

California Funeral Burial Insurance Costs Faqs Lincoln Heritage